NY CHAR410-A 2010 free printable template

Show details

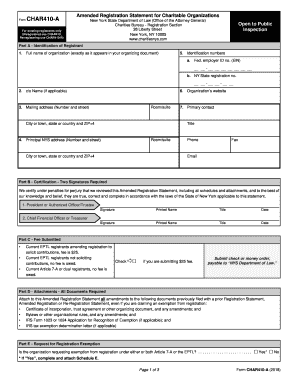

G Yes G No If Yes complete and attach Schedule E. Page 1 of 3 Form CHAR410-A 2010 Part F - Organization Structure - Provide Only Information Changed Since Last Registration Amended Registration Re-Registration or Annual Filing 1. Form CHAR410-A Amended Registration Statement for Charitable Organizations For existing registrants only Unregistered use CHAR410 Re-registering use CHAR410-R New York State Department of Law Office of the Attorney General Charities Bureau - Registration Section 120...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign char410 a

Edit your char410 a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your char410 a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit char410 a online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit char410 a. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY CHAR410-A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out char410 a

How to fill out NY CHAR410-A

01

Begin by gathering all necessary tax documents including your previous year's tax return.

02

Download the NY CHAR410-A form from the New York State Department of Taxation and Finance website.

03

Fill in your organization’s name, EIN, and contact information at the top of the form.

04

Complete the 'Part I' section, which includes details about your organization’s type and fiscal year.

05

In 'Part II', report your organization's revenue sources, ensuring accuracy and completeness.

06

If your organization qualifies for the tax-exempt status, check the appropriate box in 'Part III'.

07

Provide a signed declaration at the end of the form, confirming all information is true and accurate.

08

Submit the completed form by the due date to the appropriate New York State tax office.

Who needs NY CHAR410-A?

01

Nonprofit organizations operating in New York State that seek tax-exempt status or need to report their income for tax purposes.

Instructions and Help about char410 a

Fill

form

: Try Risk Free

People Also Ask about

Can NY CHAR500 be filed electronically?

The Charities Bureau has an online portal for submitting charities' annual financial filings. This interactive version of the CHAR500 offers a streamlined process that allows uploading of all required documents, ePayment, and eSignature.

Can CHAR500 be signed electronically?

Annual filing form The Charities Bureau has an online portal for submitting charities' annual financial filings. This interactive version of the CHAR500 offers a streamlined process that allows uploading of all required documents, ePayment, and eSignature.

How do I register a charity in NY?

A charity makes its initial registration with the Charities Bureau by filing Form CHAR 410, along with copies of its certificate of incorporation, bylaws, application for tax-exempt status (Form 1023), and tax-exempt determination letter, and paying the applicable filing fee.

How do I register a charity in New York?

How to Register. Registering requires your nonprofit to file an application with the New York State Department of Law (Office of the Attorney General) Charities Bureau Registration Section and pay a filing fee.

How much does it cost to file for CHAR500?

~ $25, if the NET WORTH is less than $50,000 DUAL filers are registered under both 7A and EPTL.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is char410 a?

It is not clear what "char410" refers to as it does not appear to be a commonly recognized term or acronym. More context is needed to provide a specific answer.

How to fill out char410 a?

To fill out Char410A, follow these steps:

1. Begin by entering the business’s name, address, and federal employer identification number (FEIN) at the top of the form.

2. Provide the details of the shareholder or member, including their name and SSN, FEIN, or ITIN (if applicable), mailing address, and percentage of ownership.

3. In Part I, indicate the type of tax due and the tax year. If you are filing an extension, mark the appropriate box and enter the extension date.

4. Complete Part II by calculating the tax due. If the tax year is less than 12 months, use the annualization worksheet to determine the adjusted tax amount.

5. Enter any estimated tax payments made for the tax year in Part III.

6. If there were any tax overpayments from a prior year that you wish to credit to the current tax, fill out Part IV accordingly.

7. In Part V, calculate the total tax due or overpayment by adding or subtracting the amounts from Parts II, III, and IV.

8. Sign and date the form at the bottom, providing your title and telephone number.

Remember to keep a copy of the completed form for your records and send the original to the relevant tax authority along with any required payment. However, it is always recommended to consult a tax professional or CPA for accurate and personalized guidance when filling out tax forms.

What is the purpose of char410 a?

There is no specific information available regarding the purpose of the term "char410 a." It could be a misspelling or abbreviation of a specific term or could refer to a programming or symbolic representation in a particular context. In order to provide a more accurate answer, additional context or clarification is needed.

What information must be reported on char410 a?

CHAR410-A is a form used by banks and other financial institutions to report changes in financial and non-financial information for correspondent and respondent banks. The specific information that must be reported on CHAR410-A includes:

1. Identification information: The form generally requires the reporting bank to provide its own identifying information, such as name, address, official institution number, and any relevant tax identification numbers.

2. Correspondent bank information: The reporting bank must provide details about the correspondent bank involved in the transaction, including its name, address, institution number, and any tax identification numbers.

3. Ownership information: The form may require information about the ownership structure of the correspondent bank, such as details of ownership (i.e., names and percent of ownership) by other banks or individuals. This helps in identifying any potential conflicts of interest or risks associated with the correspondent bank.

4. Financial information: The reporting bank should report financial data related to the correspondent bank, such as its financial statements, capital adequacy ratios, and any relevant information about its financial position.

5. Non-financial information: The form may also require reporting of non-financial information, such as operational data, compliance with anti-money laundering (AML) regulations, customer due diligence procedures, and any other relevant information related to the correspondent bank's activities.

6. Risk assessment: The reporting bank must assess the risk associated with the correspondent bank and provide relevant details about the risk assessment process, risk rating, and any actions taken or planned to mitigate the identified risks.

It is important to note that the specific information required on CHAR410-A may vary between jurisdictions and regulatory bodies. Therefore, it is advisable for reporting banks to consult the relevant regulatory guidelines or instructions provided by the reporting authority to ensure accurate and complete reporting.

How can I send char410 a to be eSigned by others?

To distribute your char410 a, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I fill out the char410 a form on my smartphone?

Use the pdfFiller mobile app to complete and sign char410 a on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit char410 a on an Android device?

You can make any changes to PDF files, such as char410 a, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is NY CHAR410-A?

NY CHAR410-A is a form used by nonprofit organizations in New York State to report information regarding their activities, finances, and governance as required by the New York State Attorney General's office.

Who is required to file NY CHAR410-A?

Nonprofit organizations that are registered in New York State and have an annual revenue of $25,000 or more are required to file NY CHAR410-A.

How to fill out NY CHAR410-A?

To fill out NY CHAR410-A, organizations need to provide information such as their mission statement, revenue and expense details, program accomplishments, and board member information. It is recommended to carefully read the instructions provided with the form.

What is the purpose of NY CHAR410-A?

The purpose of NY CHAR410-A is to ensure transparency and accountability of nonprofit organizations operating in New York State, helping to inform the public about their activities and financial health.

What information must be reported on NY CHAR410-A?

NY CHAR410-A requires organizations to report information including their name, address, mission, governing board members, financial statements, and details about their programs and accomplishments.

Fill out your char410 a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

char410 A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.